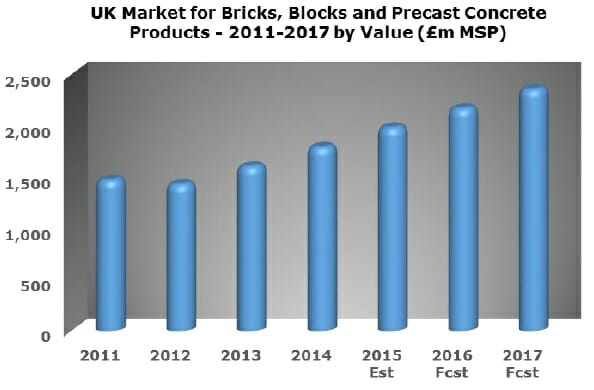

Demand for bricks, blocks, concrete precast products, cast stone and natural stone products is reliant on a wide range of factors, though housebuilding levels are undoubtedly a key driver. According to a new report from AMA Research, the market grew by around 25% by value between 2012 and 2014. A further 11% growth is forecast for 2015 and current estimates indicate that a recovery to pre-recessionary levels is possible by 2017.

Key specific factors trends that drive this market include UK and EU economic factors, the health and performance of the housing sector, levels of public sector investment in major projects and developments, business confidence & investment, as well as consumer confidence and spending.

Bricks were estimated to account for around 30% share of the total market in 2014, with indications that the strong growth experienced 2013-15 will continue into 2016 with forecasts of a further increase of over 10%. UK manufacturers of bricks have been under significant pressure by the sudden spike in demand after 5 years of volume decline and significant cuts in production. As a result, all the major players have been reopening mothballed plants, creating jobs and increasing shifts, as well as investing in technology and skills in order to boost output.

Precast concrete blocks have seen a similar rise in demand, with sales rebounding in 2013 after two years of decline, and signs of further strengthening of demand in 2014 and 2015. Block manufacturers have also had to adjust to the surge in housebuilding activity, although according to industry information there are now no discernible shortages, and current demands are being met.

The market for precast concrete structural building products increased by around 9% in 2014, with current indications of similar growth by the end of 2015. This sector incorporates a wide range of products, including crosswall panels which are estimated to account for around 20% share, while flooring, stairs, landings & balconies account for a combined share of over 35% of the ‘precast concrete’ sector.

Natural stone products used in building applications recorded around 10% growth in 2014, following a similar increase in the previous year, with market values estimated at around £100m.

“The total market for bricks, blocks, concrete precast and natural stone products is likely to continue on its relatively strong path of growth in the medium term with good growth in housebuilding and returning confidence in the private commercial sector likely to underpin value growth”, said Jane Tarver, AMA Research “However growth rates for individual product sectors will vary”.

The general trend is positive and current forecasts indicate good rates of growth of 7-9% to 2019. Undoubtedly, recent Government announcements of a significant boost to housing will underpin growth in the market over the medium term and give confidence to manufacturers to invest in new production capacity. However, market performance is also affected by global demand, supply and pricing issues, which remain volatile, as well as the performance of the UK construction sector.

The ‘Bricks, Blocks and Precast Concrete Products Market Report – UK 2015-2019 Analysis’ report is published by AMA Research, a leading provider of market research and consultancy services with over 25 years’ experience within the construction and home improvement markets. The report is available now and can be ordered online at www.amaresearch.co.uk or by calling 01242 235724.